irk-pal.ru

News

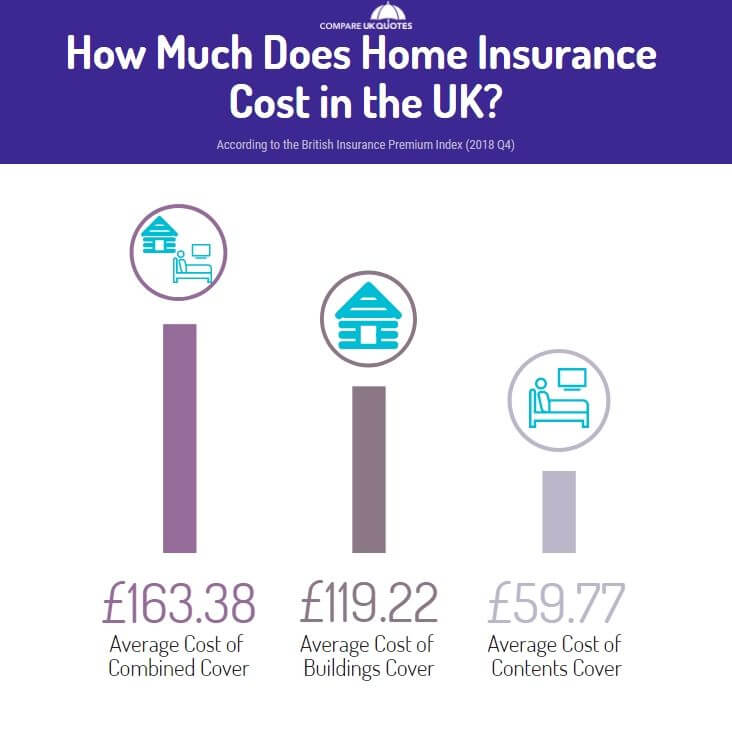

What Is A Good Rate For Home Insurance

The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on numerous factors. Here's a full rundown of. Home Insurance Calculator ; Allstate · 79 · $/mo ; State Farm · 86 · $/mo ; USAA · 86 · $/mo ; Capital Insurance Group · 56 · $/mo ; Travelers · 69 · $/mo. For homeowners with good credit, the national average cost of home insurance is $2, per year for $, in dwelling coverage. Homeowners with poor. In addition to the discounts and credits to the rate that may apply for Asking the insurer for the "best coverage" may result in what the insurer. The average annual cost of U.S. homeowners insurance is $2, — or $ per month, according to data from Quadrant Information Services. Nationally, the average homeowner's insurance rate is $1, annually —which averages to $ monthly — for a home valued at $, This number could. The average price of home insurance in the US is $1, per year, according to the National Association of Insurance Commissioners (NAIC). That makes the. So, aim to purchase an amount of coverage at least equal to the estimated replacement cost. Get a homeowners insurance quote. ZIP Code. Your safest bet is to buy coverage worth at least as much as your assets. Umbrella or excess liability coverage can provide this added protection. It increases. The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on numerous factors. Here's a full rundown of. Home Insurance Calculator ; Allstate · 79 · $/mo ; State Farm · 86 · $/mo ; USAA · 86 · $/mo ; Capital Insurance Group · 56 · $/mo ; Travelers · 69 · $/mo. For homeowners with good credit, the national average cost of home insurance is $2, per year for $, in dwelling coverage. Homeowners with poor. In addition to the discounts and credits to the rate that may apply for Asking the insurer for the "best coverage" may result in what the insurer. The average annual cost of U.S. homeowners insurance is $2, — or $ per month, according to data from Quadrant Information Services. Nationally, the average homeowner's insurance rate is $1, annually —which averages to $ monthly — for a home valued at $, This number could. The average price of home insurance in the US is $1, per year, according to the National Association of Insurance Commissioners (NAIC). That makes the. So, aim to purchase an amount of coverage at least equal to the estimated replacement cost. Get a homeowners insurance quote. ZIP Code. Your safest bet is to buy coverage worth at least as much as your assets. Umbrella or excess liability coverage can provide this added protection. It increases.

Great rate. Wonderful customer service. Answer all my questions expeditiously especially since I am purchasing property out of state. Highly recommended. Nationally, the average homeowners insurance premium was $1, as of , according to the most recent data from the National Association of Insurance. The national average cost of home insurance is $2, per year for a policy with a $, dwelling limit. This evens out to about $ per month. But these. For homeowners with good credit, the national average cost of home insurance is $2, per year for $, in dwelling coverage. Homeowners with poor. Key Takeaways · USAA is the No. 1 rated home insurance company, according to our study. · Amica is the cheapest homeowners insurance company in our rating. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). The cost of homeowner's coverage depends largely on where you live. Crime rates vary from community to community, as does access to your local fire department. Buy your home and auto policies from the same insurer. Some companies that sell homeowners, auto and liability coverage will take 5 to 15 percent off your. What are some key factors driving up home insurance rates? Extreme weather We use cookies to deliver the best possible experience on our website and enable. According to a recent study by the Insurance Information Institute, the cost of the average homeowners insurance policy across the country was $1, in Home Insurance Rate Comparison. Rate Comparison Chart (Updated 08/) Keep These Basics in Mind. This guide lists annual rates for four typical homeowners. While costs of $3, to $3, per year may sound high, they may be reasonable considering the value of the home is $, Here are some. The average premium to insure a home with a replacement cost of $, is $97 per month, while a $, dwelling limit costs about $ a month. This. Use an independent insurance broker that will check pricing across multiple providers to get you the best deal on the coverage you're looking. How much does home insurance cost? Find out how much you can expect to pay monthly or yearly so you're prepared to shop and save. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. You have many choices when it comes to homeowners insurance, but Mercury is the smart and best choice with affordable rates, first-class coverages and great. Bundle and Save. Get your car insurance and your homeowners insurance policy together from GEICO and you could receive a reduced rate on your vehicle insurance. homeowners insurance coverage options that might be a good fit for you. Back Where you live can impact recommended coverages and cost of your homeowners. The Colorado Division of Insurance has created this report, to provide consumers an opportunity to compare auto insurance premium rates in Colorado.

What Are Virtual Offices

Virtual Offices in New York include Mail Handling, professional business address and Meeting Rooms delivered by our local Alliance team. Virtual offices are everything a physical office is, minus the physical office itself. Many virtual offices can be completely customised to your needs. WHAT ARE VIRTUAL OFFICES? A virtual office might be a flexible workspace or just a P.O. box and is not a traditional “brick and mortar” building. With Northwest virtual office service, you get a real physical address and a unique suite number, so you can use the address to open a bank account. We also. Virtual Office Services are the perfect solution for when you need the benefits and support of an office without the cost of a physical workspace. Why a Virtual Office · Local mail drop-off and pick-up · Onsite locked mailboxes · Mail forwarding · Courier management · Round-the-clock access to the building. A virtual office is a service: it enables people to work remotely and access a range of business functions through the internet. A Virtual Office gives you a business address, phone number, call handling, mail forwarding, and access to other office facilities and services. A New York virtual office is a unique local address and phone number at a staffed physical location you can use as your business address, even if your company. Virtual Offices in New York include Mail Handling, professional business address and Meeting Rooms delivered by our local Alliance team. Virtual offices are everything a physical office is, minus the physical office itself. Many virtual offices can be completely customised to your needs. WHAT ARE VIRTUAL OFFICES? A virtual office might be a flexible workspace or just a P.O. box and is not a traditional “brick and mortar” building. With Northwest virtual office service, you get a real physical address and a unique suite number, so you can use the address to open a bank account. We also. Virtual Office Services are the perfect solution for when you need the benefits and support of an office without the cost of a physical workspace. Why a Virtual Office · Local mail drop-off and pick-up · Onsite locked mailboxes · Mail forwarding · Courier management · Round-the-clock access to the building. A virtual office is a service: it enables people to work remotely and access a range of business functions through the internet. A Virtual Office gives you a business address, phone number, call handling, mail forwarding, and access to other office facilities and services. A New York virtual office is a unique local address and phone number at a staffed physical location you can use as your business address, even if your company.

Davinci is the premier virtual office provider with locations all over the world. This is perfect for entrepreneurs at all levels of their careers who don't. Venture X is your complete solution to upgrade with a virtual office space and address for your business and take your work to the next level. Our virtual membership options combine essential services to provide you with a notable address, efficient mail handling, seamless phone services, and on-. Virtual offices are ideal for startups, remote workers, small businesses and freelancers, as well as for larger companies seeking to establish a presence in a. A virtual office is part of the flexible workspace industry that provides businesses with any combination of services, space and/or technology. In this article, we'll explore the key factors that can help you determine whether a virtual office or a physical office is the right fit for your business. Instead of creating a system designed to connect remote employees to a fixed location, these virtual offices are entirely detached from the real estate of. Using the tool, workers can easily reserve workspaces, meeting spaces, conference lines, and other shared assets. Deploying Virtual Office helps your. A virtual office is a service that your company can attain by renting an office space without you and the staff members being physically in that place. Rent a virtual office and create a professional business image with your virtual office company address and phone number. We can receive your mail. Select an Office Evolution location that works for you · Choose the mail plan that suits your needs · Share your new business address and start experiencing the. A virtual office can be a great way to get the benefits of having a physical office without renting or purchasing physical space. Virtual offices can range from $50 to $ per month or more, depending on various factors such as what services your business requires. A Virtual Office gives you a business address, phone number, call handling, mail forwarding, and access to other office facilities and services. Opus Virtual Offices has over locations. Virtual services offer a way to improve your business & reduce overhead. $ a month with no fine print. A virtual office is one that allows employees to interact with each other, customers and suppliers from a variety of locations – there is no central. A virtual office allows for easy expansion of your business. You can establish a presence in new locations or even have multiple offices around the country. A virtual office provides businesses with a physical address and office-related services without the need for a dedicated, physical office space. A virtual office address is optional for remote companies, allowing them to have a physical address and to receive mail.

Workers Comp For Self Employed

Holds or has applied for a federal employer identification number with the federal internal revenue service or has filed business or self- employment income tax. No, if you are self-employed you are not required to carry Workers Compensation; however, the State of Pennsylvania now allows sole proprietors to purchase. The short answer: it depends. While independent contractors are not eligible for workers' compensation in New York, whether you are considered an “employee” for. The earnings of a person who is working as an independent contractor are subject to self-employment tax. Independent contractors cannot pursue California. Can you qualify for workers' comp if you're self-employed in New York? A workers comp breakdowns your options for workers comp now. Workers' Compensation Insurance or Certifications of Self-Insurance for correction are below. Upon employing anyone in a manner that is subject to the workers. If you are a self-employed worker, you typically aren't eligible to be covered by the workers' compensation coverage of the party for whom you render services. self-insured employers for purposes of paying workers' compensation benefits to their employees. employed by the household; (d) farm laborers when fewer. We know how to help you file for workers' compensation benefits even if you are self-employed. There are many cases where this is possible. Holds or has applied for a federal employer identification number with the federal internal revenue service or has filed business or self- employment income tax. No, if you are self-employed you are not required to carry Workers Compensation; however, the State of Pennsylvania now allows sole proprietors to purchase. The short answer: it depends. While independent contractors are not eligible for workers' compensation in New York, whether you are considered an “employee” for. The earnings of a person who is working as an independent contractor are subject to self-employment tax. Independent contractors cannot pursue California. Can you qualify for workers' comp if you're self-employed in New York? A workers comp breakdowns your options for workers comp now. Workers' Compensation Insurance or Certifications of Self-Insurance for correction are below. Upon employing anyone in a manner that is subject to the workers. If you are a self-employed worker, you typically aren't eligible to be covered by the workers' compensation coverage of the party for whom you render services. self-insured employers for purposes of paying workers' compensation benefits to their employees. employed by the household; (d) farm laborers when fewer. We know how to help you file for workers' compensation benefits even if you are self-employed. There are many cases where this is possible.

workers' compensation. In the past, independent contractors and other self-employed professionals had limited commercial insurance options. However, with. • Obtain approval from the Commission to be self-insured (must meet minimum requirements) A: No, domestic employment is one type of employment for which. The short answer: it depends. While independent contractors are not eligible for workers' compensation in New York, whether you are considered an “employee”. Get online workers' compensation quotes for freelancers from top insurance companies. Good advice, affordable coverage, and great service. Generally, workers comp doesn't cover owners. If you get hurt on the job, your health insurance will ask to see if they can have someone else. Workers' compensation coverage is required for sole proprietors with employees, including part-time employees, borrowed employees, leased employees, family. Workers' compensation can provide coverage for people who are self-employed. While it may not be required by law, many business owners opt to purchase workers'. A sole proprietor (self-employed individual) working in his or her sole Workers' compensation is an employee benefit which must be provided by the employer. The answer generally depends on the choices you make for your business. In Ohio, any business with employees–even a single employee–is required to carry. Illinois law requires employers to provide workers' compensation insurance for almost everyone who is hired, injured, or whose employment is localized in. self-employment income tax returns based on work or service performed in the workers' compensation insurance policy or contribute towards a workers'. A worker is anyone you pay to do work for you who is not an independent contractor. You do not have to provide workers' compensation coverage to independent. Workers' Compensation approval to individually self-insure their potential liability. Employers may also be eligible for joining a certified group self. employed by the sponsor of the event. Accepted Methods for Providing Workers' Compensation to self-insure their workers' compensation obligations. Workers' Comp claims for contractors/self-employed/sole proprietors are handled differently than other employees. Independent contractors are not eligible for. If you're a sole proprietor in New York, the law does not require buying workers' compensation insurance. However, there are few situations where getting one. Self-Employed Workers & Independent Contractors In the state of Oklahoma, when you work completely by yourself, there isn't a requirement to carry workers'. Otherwise, workers' compensation coverage is required. defines “Sole proprietor” as “a self-employed owner of an unincorporated business and includes. workers' compensation coverage, commercial insurance and self-insurance. employee's return to work or termination from employment. Independent. Workers' Comp Insurance For Self-Employed If you own your own business, worker's compensation insurance should still be an important part of your business.

Are Interest Rates Still Low

Who Benefits From a Low Interest Rate Environment? The Federal Reserve lowers interest rates in order to stimulate growth during a period of economic decline. Mortgage rates ; Today's rate. year fixed (new purchase). As low as. · ; Today's rate. year fixed (new purchase). As low as. · Over the past two years, the Fed has raised its benchmark rate, or the federal funds rate, to a target range of % to %. Learn more: What prospective. Do Interest Rates Remain Low Despite the Accumulation of Govern- ment Debt in Japan? *. TANAKA Kenji. Professor, Faculty of Economics, Teikyo University. The Federal Reserve hasn't changed rates since July but experts believe a cut is likely in September. This can influence the interest rates set by financial institutions such as banks. If the base rate goes up, it's likely lenders may want to charge more as the. Interest rates have been rising over the last few months at a pace we haven't seen since the late '70s. To put it simply, it's the mortgage rate that saves you the most money once you factor in fees, closing costs, and loan terms. The Fed lowers interest rates in order to stimulate economic growth, as lower financing costs can encourage borrowing and investing. However, when rates are too. Who Benefits From a Low Interest Rate Environment? The Federal Reserve lowers interest rates in order to stimulate growth during a period of economic decline. Mortgage rates ; Today's rate. year fixed (new purchase). As low as. · ; Today's rate. year fixed (new purchase). As low as. · Over the past two years, the Fed has raised its benchmark rate, or the federal funds rate, to a target range of % to %. Learn more: What prospective. Do Interest Rates Remain Low Despite the Accumulation of Govern- ment Debt in Japan? *. TANAKA Kenji. Professor, Faculty of Economics, Teikyo University. The Federal Reserve hasn't changed rates since July but experts believe a cut is likely in September. This can influence the interest rates set by financial institutions such as banks. If the base rate goes up, it's likely lenders may want to charge more as the. Interest rates have been rising over the last few months at a pace we haven't seen since the late '70s. To put it simply, it's the mortgage rate that saves you the most money once you factor in fees, closing costs, and loan terms. The Fed lowers interest rates in order to stimulate economic growth, as lower financing costs can encourage borrowing and investing. However, when rates are too.

Interest rates were cut sharply in and remain extremely low by historical standards. With rates so low for so long do they really matter anymore? Yes. When the Prime Rate is high, borrowing money is more expensive. This causes increased interest rates and lower spending. This also effectively lowers inflation. While low rates tend to stimulate the economy,in the long run they could result in inflation and economic irk-pal.ru who keep money in. When inflation is too low, it is also bad for the economy. Decreasing the policy interest rate can stimulate economic activity and cause inflation to rise. Mortgage interest rates are expected to decline gradually in , but most "Existing home inventory is expected to remain low, but relief from. Mortgage rates continue their descent, plunging to their lowest level this week since February The average rate on the benchmark year mortgage fell. Even if your score is low, you may still have options. Contact a housing counselor to learn more. Credit score has a big impact on the rate you'll receive. lower on-tenor maturity for that deposit product when determining its Savings and interest checking account rates are based on the $2, product. Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online. In the opposing scenario, the FOMC may set a lower federal funds rate target to spur greater economic activity. H Selected Interest Rates Federal Interest. Even though rates have come down over the summer, home sales have been lackluster. On the refinance side however, homeowners who bought in recent years are. lower on-tenor maturity for that deposit product when determining its Savings and interest checking account rates are based on the $2, product. If you seem like a safe bet to a lender, you're more likely to be offered a lower interest rate. Factors you can change: Your credit score. Mortgage lenders use. Since the (US) government refuse to lower their spending significantly, higher rates are expected to last longer - it's unlikely that we will see such low. During COVID, the RBA reduced the cash rate to percent, so it was very cheap to borrow money and spend (also, the savings interest rates were too low, so. Interest Rate in the United States averaged percent from until , reaching an all time high of percent in March of and a record low of. The low interest rate policy of the Fed reduced the carrying costs, not surprisingly the demand for and the price of owner-occupied housing surged. From. For example, in December , the committee stated that it anticipates that exceptionally low interest rates would likely remain appropriate at least as long. A lower interest rate will cost you less over the life of a loan and credit card purchases. Interest rates will inevitably be a large part of your financial. An “N/A” interest rate is a result of market volatility and changing interest rates. Low Income (LI) Rate Lock · CalHFA Conventional (No CalHFA DPA). High.

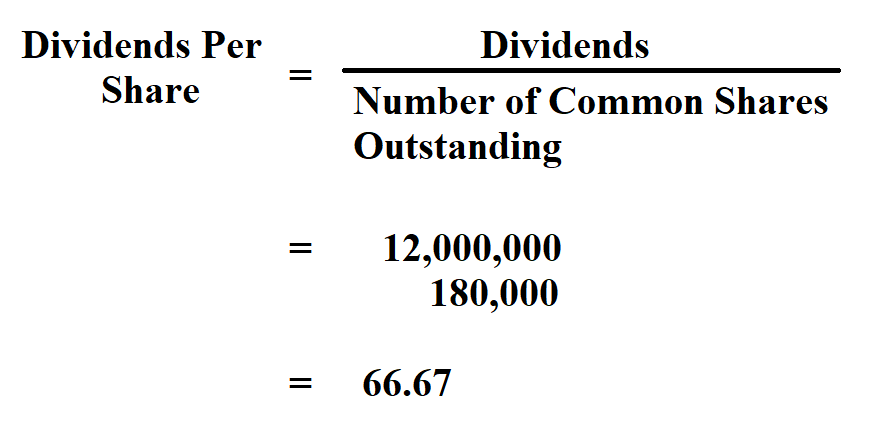

How To Get Stock Dividends

Here is the formula for dividends per share: Total dividends ÷ shares outstanding = dividends per share. Using this method to calculate dividends per share may. dividend. To be on record by this date, investors must have purchased shares by the ex-dividend date so enrolment information has time to reach the transfer. To qualify for a dividend payout, you must be a “Shareholder of Record”. That means you must already be listed as one of the company's shareholders on the. Dividends are the distribution of earnings to shareholders, prorated by the class of security and paid in the form of money, stock, scrip, or, rarely, company. Enter the number of shares you own and click calculate to find out how much the selected dividend payment was worth to you. A dividend is like a reward to shareholders for keeping money invested in the company. It is typically expressed as a per-share value, just as a company's. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. They may provide some hedge. Once a business earns profits, it can invest the money back into the business, save it for emergency expenses, buy back stocks from the shareholders, or pay. So if you own 1, shares of a company, and that company pays a dividend per share of $, you would be paid $ The amount a company pays in dividends is. Here is the formula for dividends per share: Total dividends ÷ shares outstanding = dividends per share. Using this method to calculate dividends per share may. dividend. To be on record by this date, investors must have purchased shares by the ex-dividend date so enrolment information has time to reach the transfer. To qualify for a dividend payout, you must be a “Shareholder of Record”. That means you must already be listed as one of the company's shareholders on the. Dividends are the distribution of earnings to shareholders, prorated by the class of security and paid in the form of money, stock, scrip, or, rarely, company. Enter the number of shares you own and click calculate to find out how much the selected dividend payment was worth to you. A dividend is like a reward to shareholders for keeping money invested in the company. It is typically expressed as a per-share value, just as a company's. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. They may provide some hedge. Once a business earns profits, it can invest the money back into the business, save it for emergency expenses, buy back stocks from the shareholders, or pay. So if you own 1, shares of a company, and that company pays a dividend per share of $, you would be paid $ The amount a company pays in dividends is.

Stock dividends are different to cash dividends because shareholders don't receive any money. Instead they get more shares in the company. For instance, a 5%. Stock dividends are different to cash dividends because shareholders don't receive any money. Instead they get more shares in the company. For instance, a 5%. The plan enables shareholders to invest cash dividends in common shares and acquire additional shares Get in touch with our investor relations team. Remember, the ex-dividend date is typically the same day as the record date. If investors want to receive a stock's dividend, they have to buy shares of stock. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase. You must be a stockholder of record to participate in the IBM Dividend Reinvestment option of the Computershare Investment Plan. Using the IBM Dividend. You can buy your initial shares through the Plan with a minimum initial Plan participants can reinvest all or part of their Costco cash dividends to purchase. Dividends are payments of cash or additional stock paid out to shareholders of public stocks on a regular basis. When you buy a share (or shares) of a public. With a stock dividend, stockholders receive additional shares of stock instead of cash. Stock dividends transfer value from Retained Earnings to the Common. How Do Dividends Work? Essentially, for every share of a dividend stock that you own, you are paid a portion of the company's earnings. You get paid simply. You must be a shareholder of record on the ex-dividend date, so yes you can buy the stock right before this and get paid the dividend. That. Since all orders take 1 business day to settle, make sure you buy any shares business days before the Record Date. How dividend payments are calculated for. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. In reality, the way you can make money through dividend stocks, even though the stock price drops by the amount of the dividend each time, is. Dividends are a portion of a company's cash holdings paid out to its shareholders. They are generally sent out on a scheduled basis that is determined by the. When you buy a · The management of a company decides the amount and frequency of dividend payments. · Most companies that pay dividends do so on a quarterly, half. A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the. Total dividends per year is based on the dividend ex-date. The Computershare Investment Plan, a Direct Stock Purchase and Dividend Reinvestment Plan for Cisco. If an investor owns shares and the company issues a 10% stock dividend, that investor will have shares after the dividend. Dividends are not guaranteed. Stock dividends explained. The simplest way to think of dividends is as a bonus or reward you receive simply for owning a stock. Dividends are set as a.

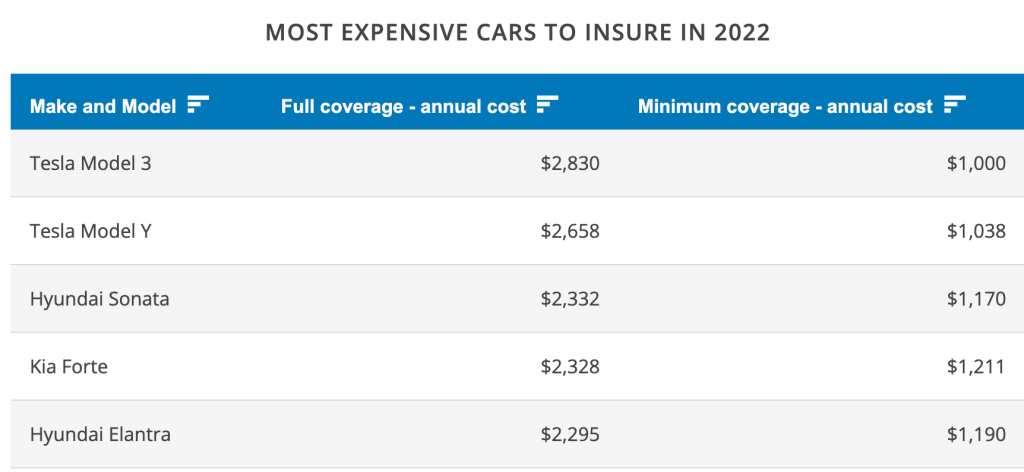

Is Tesla Expensive To Insure

Yes, it is more expensive than most vehicles to insure a Tesla, but not by much. Teslas are a very difficult car to steal because of security features and are. The average price to insure a Tesla is about $2, a year according to some surveys. However, that number can vary significantly based on where you live, your. How Much Does Tesla Insurance Cost? Full-coverage car insurance for Tesla vehicles costs an average of $4, per year or $ each month. This makes Tesla. Why compare Tesla Model 3 car insurance with Compare the Market? The Tesla Model 3 is an expensive car to insure, so you'll probably be looking for ways to. Tesla car insurance is not necessarily offered at a higher premium than electric vehicle insurance or gas-powered vehicles. Rates will depend on the make and. Insuring a Tesla works the same way it does for any other vehicle, but these electric vehicles are expensive to insure. According to the National Association of. General Tesla Insurance Cost: On average, insuring a Tesla can range from $2, to $3, annually, or $ to $ monthly. These costs are. Is Tesla More Expensive to Insure than Other Cars? Usually, yes. But it's money worth investing. According to Bankrate, the average annual insurance cost for. Higher Insurance Costs: Generally, insuring a Tesla Model S or X will cost you more than an average vehicle. Why? Well, Teslas are high-tech. Yes, it is more expensive than most vehicles to insure a Tesla, but not by much. Teslas are a very difficult car to steal because of security features and are. The average price to insure a Tesla is about $2, a year according to some surveys. However, that number can vary significantly based on where you live, your. How Much Does Tesla Insurance Cost? Full-coverage car insurance for Tesla vehicles costs an average of $4, per year or $ each month. This makes Tesla. Why compare Tesla Model 3 car insurance with Compare the Market? The Tesla Model 3 is an expensive car to insure, so you'll probably be looking for ways to. Tesla car insurance is not necessarily offered at a higher premium than electric vehicle insurance or gas-powered vehicles. Rates will depend on the make and. Insuring a Tesla works the same way it does for any other vehicle, but these electric vehicles are expensive to insure. According to the National Association of. General Tesla Insurance Cost: On average, insuring a Tesla can range from $2, to $3, annually, or $ to $ monthly. These costs are. Is Tesla More Expensive to Insure than Other Cars? Usually, yes. But it's money worth investing. According to Bankrate, the average annual insurance cost for. Higher Insurance Costs: Generally, insuring a Tesla Model S or X will cost you more than an average vehicle. Why? Well, Teslas are high-tech.

How much does it cost to insure my Tesla Model S? ; Tesla Model S · Infinity. $1, Cincinnati Insurance. $1, ; Tesla Model S · Erie. $1, USAA. If you insure with Youi, the average annual premium for a Tesla is $2, Bear in mind that your age, location and the model of Tesla you drive will also. The top 3 things to know about Tesla car insurance rates. Insurance on a Tesla is much higher than the average car insurance rates for other EVs and gas-powered. Insurance guy here, the reason they are so expensive to insure is because of the high cost to repair, the lack of Aftermarket parts and the. Tesla Insurance offers competitively priced insurance products and tools that can help you drive safer. Read our step-by-step guides to get started. Your Tesla Insurance premium is based on the Tesla vehicle you drive, your garaging address, amount you drive, your coverage selection and your Tesla vehicle's. Does EV car insurance cost more? EVs are insured by the same policies as gas-powered cars and, in principle, you're not charged more simply for driving an EV. Of course, other Teslas cost more for insurance premiums. The most expensive Tesla model to insure is a Model S, with an average monthly premium of $ Why compare Tesla Model 3 car insurance with Compare the Market? The Tesla Model 3 is an expensive car to insure, so you'll probably be looking for ways to. The average cost of car insurance for a Tesla model is about $4, per year. This is $1, worse than other luxury brands. Our car insurance comparison. Numerous reports have found that Tesla insurance is not in fact cheaper than its competitors. Tesla insurance may offer custom coverage, but shopping the market. With Tesla being a premium electric vehicle manufacturer, insuring one may cost even more than the same coverage for a more affordable option, like an electric. The average cost of car insurance for Tesla model S is $2, per year or $ per month in general, or $2, per year and $ per month with Tesla's auto. Compare the cost of insuring a Tesla vehicle, with rates starting at $87 per month. How can I get cheaper car insurance for my Tesla? · Pay annually · Pay more excess · Build a no claims bonus · Keep your car safe and secure · Lower your mileage. Compare the cost of insuring a Tesla Model 3 with different companies, with rates starting at $97 per month. Car insurance for Teslas is so expensive in part because of high repair costs and the difficulty involved in repairs. Additionally, Teslas are expensive cars. A Model 3 costs approximately $3, to insure per year. A Model X costs about $4, to insure per year. These averages from were derived from quotes. However, considering the Tesla X models, we observe that the models are the most expensive to insure. State Farm and USAA are the most affordable when we. Tesla Insurance offers full coverage options with various limits and deductibles that can be tailored to your needs.

Mortgage Rates Cincinnati Ohio

Compare today's mortgage rates for Cincinnati, OH. The mortgage rates in Ohio are % for a year fixed mortgage and % for a year fixed mortgage. home as soon as possible with the best possible home mortgage rates in in Cincinnati, Toledo and Lima OH. Refinance. Mortgage refinance in Cincinnati, Toledo. Current rates in Cincinnati, Ohio are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd party. Cincinnati Ohio Police CU Chat Logo. I can help you do anythingTry now. 2 Mortgage Rates. Purchase / Refinance Rates. Term, Rate/APR from, Points. Year VA. 1st Mortgages - Serving Southwest Ohio & surrounding areas · Terms up to 30 years · Fixed rates, adjustable rates & balloon notes · Conventional loans with as. Current 30 year-fixed mortgage refinance rates are averaging: %. Compare today's Ohio mortgage rates. Get free, customized quotes from lenders in your area to find the lowest rates. Track live mortgage rates ; Top 5 Originators in Ohio. %. US Bank. %. Pennymac Home Loans ; Originations by Property Type. %. Single Family. %. Weekly average mortgage rates since Data is provided by Freddie irk-pal.rut and Historical Mortgage Rates. Compare today's mortgage rates for Cincinnati, OH. The mortgage rates in Ohio are % for a year fixed mortgage and % for a year fixed mortgage. home as soon as possible with the best possible home mortgage rates in in Cincinnati, Toledo and Lima OH. Refinance. Mortgage refinance in Cincinnati, Toledo. Current rates in Cincinnati, Ohio are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd party. Cincinnati Ohio Police CU Chat Logo. I can help you do anythingTry now. 2 Mortgage Rates. Purchase / Refinance Rates. Term, Rate/APR from, Points. Year VA. 1st Mortgages - Serving Southwest Ohio & surrounding areas · Terms up to 30 years · Fixed rates, adjustable rates & balloon notes · Conventional loans with as. Current 30 year-fixed mortgage refinance rates are averaging: %. Compare today's Ohio mortgage rates. Get free, customized quotes from lenders in your area to find the lowest rates. Track live mortgage rates ; Top 5 Originators in Ohio. %. US Bank. %. Pennymac Home Loans ; Originations by Property Type. %. Single Family. %. Weekly average mortgage rates since Data is provided by Freddie irk-pal.rut and Historical Mortgage Rates.

year Fixed Rates. Get personalized home loan quotes on Trulia with current CA year fixed mortgage rates. Check Rates. The average Ohio rate for a fixed year mortgage is % (Zillow, Jan. ). Ohio Jumbo Loan Rates. Ohio county conforming loan limits are all $, *APR = Annual Percentage Rate. These featured interest rates assume a single-family home purchase in Cincinnati, OH, and a borrower with a credit score of. Minimum credit score of + required. Example loan in the amount of $10, for 60 months, would have a monthly payment of $, with an interest rate of. Learn more about U.S. Bank's current mortgage rates in Ohio and see how residing in different states can impact your loan. Mortgage Rates. Home / Mortgage Rates. Locations · Atlanta, Georgia () · Cincinnati, Ohio () · Columbus, Ohio () · Dayton. Getting a mortgage in Ohio · Median home price: $, · Average year fixed rate: % · Median monthly mortgage cost: $1, · Homeownership rate: 66%. Use SmartAsset's free Ohio mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and more. Let's make home happen together. We've been rolling out the welcome mat for Greater Cincinnatians like you since · Available for construction of your. Click here to find the best interest rates for Cincinnati, OH home mortgages, whether purchase, cash out, refinance, FHA, VA and more. Today's mortgage rates in Ohio are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check out our. Ohio Mortgage Rates. Current mortgage rates in Ohio are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. Mortgage rates ; %, %, % ; %, %, % ; %, %, % ; %, %, %. Today's Rates ; Loan Type. Rate. APR ; year fixed. %. % ; year fixed. %. % ; year fixed. %. %. Cuyahoga County, home to Cleveland, has the state's highest effective rate at %. Lawrence County, a small region in the south, has the lowest rate at %. Based on a year fixed rate home loan of $, with a rate of % and an APR of % the mortgage would be paid in installments of $ Based. Compare current Cincinnati, OH mortgage rates. Find the lowest Cincinnati mortgage rates by reviewing personalized loan terms for multiple programs. Lendercom finds you the lowest Cincinnati mortgage, refinance or home equity loan interest rate. Fixed rate mortgages, variable adjustable rate. Mortgage Interest Rates ; Traditional First-Time Homebuyer Program · First-Time Homebuyer Program · %, % · % ; Next Home · Non-First-Time Homebuyer. The 30 year & 20 year fixed Conventional rates we advertise today require a or better middle credit score, score is the preferred score for premium.

Business Loan Amount Calculator

Use our business loan calculator to quickly see how much your monthly loan payments could be, and how much you should borrow to help grow your business. Business loans offer a pathway to acquire necessary equipment, fund expansion projects, or even acquire other businesses. Understanding the impact and cost of. Find out if you qualify for a business loan by entering the amount you want to borrow and other key inputs into the Citizens business loan calculator today. This powerful tool is engineered to accurately calculate both the repayment amount and the overall costs associated with a business loan. borrow to take your business to the next level. Loan amount. Annual interest rate. Interest rates vary depending on the lender. Use 10% if you're unsure. Loan. Visit now to find out how much your monthly business loan payment will be based on the loan amount, interest rate and term of the loan. Our small business loan calculator will give you an idea of how much it will cost to take out a loan. Adjust the term and add extra monthly payments. Enter your loan amount and we will calculate your monthly payment. You can then examine your monthly payment, total of all payments made, and total interest. Calculate your monthly loan payments for a small business working capital loan to help you buy, start, or expand a business. Use our business loan calculator to quickly see how much your monthly loan payments could be, and how much you should borrow to help grow your business. Business loans offer a pathway to acquire necessary equipment, fund expansion projects, or even acquire other businesses. Understanding the impact and cost of. Find out if you qualify for a business loan by entering the amount you want to borrow and other key inputs into the Citizens business loan calculator today. This powerful tool is engineered to accurately calculate both the repayment amount and the overall costs associated with a business loan. borrow to take your business to the next level. Loan amount. Annual interest rate. Interest rates vary depending on the lender. Use 10% if you're unsure. Loan. Visit now to find out how much your monthly business loan payment will be based on the loan amount, interest rate and term of the loan. Our small business loan calculator will give you an idea of how much it will cost to take out a loan. Adjust the term and add extra monthly payments. Enter your loan amount and we will calculate your monthly payment. You can then examine your monthly payment, total of all payments made, and total interest. Calculate your monthly loan payments for a small business working capital loan to help you buy, start, or expand a business.

Principal Loan Amount ($); Interest rate (%); Maturity (years); Amortization (years). The duration of most Commercial real estate mortgages varies from five. An EMI calculator is the best tool that you can use for computing EMIs before you apply for a loan. This straightforward tool requires only a few key inputs. VA Mortgage Loans up to $, with no down payment. Business loan amounts for veterans up to $, and year terms. Apply for a personal loan for any. You can also easily determine the impact of your down payment. Purchase Amount. $. Interest Rate. %. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. The first is the systematic repayment of a loan over time. The second is used in the context of business accounting and is the act of spreading the cost of an. Determining monthly payments with the SBA loan calculator. There are three main factors to an SBA loan payment: loan amount, interest rate and loan term. Loan amount (how much you're borrowing); Interest rate; Loan term (the time you have to repay the loan, which affects your number of monthly payments); Extra. Amount seeking; Loan term; Annual rate; Origination fee. From the calculator, you will get an estimated monthly payment, origination fee, and total repayment. Our business loan calculator is a useful tool for understanding the borrowing costs for your small business. Simply enter different loan amounts, interest. Use this calculator to determine estimated monthly payments for a fully amortizing, fixed rate business loan. Calculate monthly payments and interest costs for a range of loans with the RBC business loan calculator. This calculator factors in the total loan amount, length of loan and interest rate to determine an approximate loan cost for you. You can also use our affordability calculator to see how much funding your business can potentially get. Loan Amount. dollar-icon. Estimated. Lenders will also look at your sales when assessing your eligibility for a loan. According to Joseph, the size of your loan will depend on the amount of sales. Use this commercial loan calculator to determine the total amount of your loan (principal + interest) and how much you have to contribute monthly to pay it. Utilise the Business Loan Calculator to determine your monthly EMI payments. Loan Amount (rupee). Our business loan calculator can provide you with an estimate as to what funding amounts are available, and what your monthly repayment range may look like. Commercial Property Loan Calculator. This tool figures payments on a commercial property, offering payment amounts for P & I, Interest-Only and Balloon.

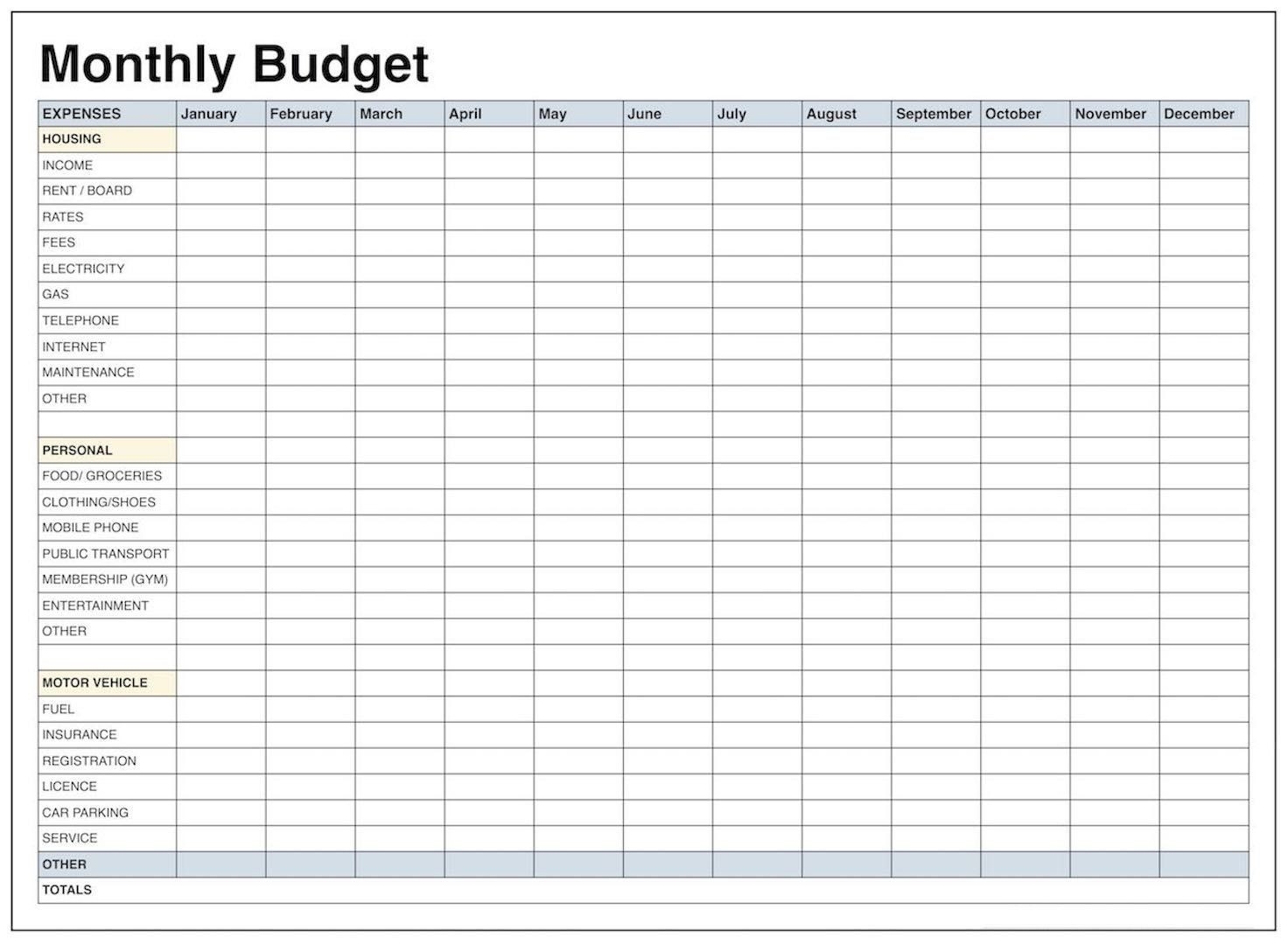

Free Financial Spreadsheet

Browse our free templates for budget designs you can easily customize and share. Simple Wedding Budget Planning Worksheet Checklist. Checklist by Rose Lindo. Free Budget Templates. Download spreadsheets for creating personal, family, household and student budgets. Spreadsheet® budget templates are fairly simple. Gain control of your finances by downloading and using one of these free monthly budget templates for a plethora of scenarios. finances and make enormous strides in our financial position since Introducing the free budget spreadsheet! You can get it by joining my newsletter. The Simple Weekly Budget Template is a free customizable spreadsheet you can use to monitor and plan all your weekly expenses, regardless of their type. Why. Microsoft Excel isn't all about complex formulas. These free budget templates are an easy way to get an overview of your cash flow (monthly expenses versus. 6 Free Budget Template Spreadsheets · Best yearly budget template: Vertex42 · Best monthly budget template: Vertex42 · Best weekly budget template: Spreadsheet Savvy Ladies is a (c)(3) nonprofit organization providing free financial education to all women. Your Budgeting Worksheet. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. Browse our free templates for budget designs you can easily customize and share. Simple Wedding Budget Planning Worksheet Checklist. Checklist by Rose Lindo. Free Budget Templates. Download spreadsheets for creating personal, family, household and student budgets. Spreadsheet® budget templates are fairly simple. Gain control of your finances by downloading and using one of these free monthly budget templates for a plethora of scenarios. finances and make enormous strides in our financial position since Introducing the free budget spreadsheet! You can get it by joining my newsletter. The Simple Weekly Budget Template is a free customizable spreadsheet you can use to monitor and plan all your weekly expenses, regardless of their type. Why. Microsoft Excel isn't all about complex formulas. These free budget templates are an easy way to get an overview of your cash flow (monthly expenses versus. 6 Free Budget Template Spreadsheets · Best yearly budget template: Vertex42 · Best monthly budget template: Vertex42 · Best weekly budget template: Spreadsheet Savvy Ladies is a (c)(3) nonprofit organization providing free financial education to all women. Your Budgeting Worksheet. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget.

We've created an intelligent, interactive Canadian budget calculator spreadsheet in Excel that you can download and use for free as your personal budget. Delbridge Rental Property Spreadsheet. Utilize this free Real Estate Reporting Template to track, measure, and provide reports on tenant lease data across. This version of free budgeting spreadsheets is universal. It works well for college students who want to budget money easily, parents who want to control the. Always keep track of your financial health. These free Excel spreadsheet templates are the tools you need to manage your money. If you have access to a Google account, Google Sheets has monthly and yearly budget templates for free. I use a budget spreadsheet; screenshot. Free Budget Spreadsheets on the Internet · 1. Household budgeting spreadsheet · 2. Williams Budgeting Sheet · 3. Free monthly budget templates · 4. Google Sheets. financial decisions. This spreadsheet is designed to be used in Google Sheets with your free Google account and can be used on your computer, smartphone. Thomas Frank's Free Budget Spreadsheet Tool. I've been building my own custom financial planning and budgeting spreadsheet for years, and now I'm giving it away. Scroll through the available free downloads below, and find the best fit for your Excel budgeting needs. Looking to track your personal daily spending? Try our. Set your budget categories once. Your spreadsheet automatically categorize your transactions after. Need to re-categorize all transactions? No worries, you can. Choose from a wide selection of Google Docs budget template spreadsheets, including monthly, business, personal budget templates, and more. Free Budget Templates. Download spreadsheets for creating family, personal Thumbnail - Personal Budget Spreadsheet. - Yearly budget planner with. financial plan, and these budget spreadsheets can help Vertex42 enables you to choose from a variety of free spreadsheets, including income and expense. With our Budget Spreadsheet Template, you won't need additional financial planning tools. free budget templates in Google Docs to cater to your diverse. Create Your Budget. A, B, C, D, E, F, G. 1. 2, MONTHLY BUDGET WORKSHEET. 3, Enter your monthly income (Incoming Money), expenses (Outgoing Money) and savings . Free excel budgeting templates for · 1. Expense tracker by Sheetgo · 2. Monthly Budget Planner by Money Under 30 · 3. Annual Budget Planner by Budget. Free Monthly Budget Template (Simple Budget Tracker Spreadsheet). Always wondering where all your money is going? The solution is easy. A simple budget. Derek. Free Budget Spreadsheet Template. Easily do your budgeting and see your income and expenses in one place! Download Free Budget Spreadsheet Template Now. Use this worksheet to see how much money you spend this month. Then, use this month's information to help you plan next month's budget. Below are all the other free budget binder printables I've created since CBB Excel Budget Spreadsheet Actual Family Budget Excel. Build Your Budget.

What Is A Debt Buyer

Debt buyer (United States) A debt buyer is a company, sometimes a collection agency, a private debt collection law firm, or a private investor, that purchases. A junk debt buyer is a company that buys debt that has been deemed uncollectible by the original creditor, or charged off. Please note that if a debt is “. The debt buyer purchases from the creditor an electronic file, or “datastream,” of information about the portfolio of debts. It must be documented and signed by both parties. This means a debt buyer cannot sue for additional interest, services fees, attorney fees or collection charges. Debt buyers purchase charged off debts that creditors have not been able to collect on. In some instances, debt buyers have illegally attempted to collect on. Can You Buy Your Own Debt? If debt buyers are able to purchase your debt at such a low cost, shouldn't you be able to? Unfortunately, individuals are not able. A debt buyer is a company, sometimes a collection agency, a private debt collection law firm, or a private investor, that purchases delinquent or charged-off. A debt collector tries to recover past-due debts for creditors in return for a fee. A 'debt purchaser' buys unpaid debts from creditors in bulk. Let's say you owe £ A debt purchaser may buy that debt for £ They will then keep asking you. Debt buyer (United States) A debt buyer is a company, sometimes a collection agency, a private debt collection law firm, or a private investor, that purchases. A junk debt buyer is a company that buys debt that has been deemed uncollectible by the original creditor, or charged off. Please note that if a debt is “. The debt buyer purchases from the creditor an electronic file, or “datastream,” of information about the portfolio of debts. It must be documented and signed by both parties. This means a debt buyer cannot sue for additional interest, services fees, attorney fees or collection charges. Debt buyers purchase charged off debts that creditors have not been able to collect on. In some instances, debt buyers have illegally attempted to collect on. Can You Buy Your Own Debt? If debt buyers are able to purchase your debt at such a low cost, shouldn't you be able to? Unfortunately, individuals are not able. A debt buyer is a company, sometimes a collection agency, a private debt collection law firm, or a private investor, that purchases delinquent or charged-off. A debt collector tries to recover past-due debts for creditors in return for a fee. A 'debt purchaser' buys unpaid debts from creditors in bulk. Let's say you owe £ A debt purchaser may buy that debt for £ They will then keep asking you.

A debt buyer is different than a collection agency. Debt buyers purchase old debts from original creditors, like banks, credit card companies, and car loan. This article is for anyone who may be interested in getting into the debt collection industry and wants to learn some basic information about buying debt. A debt buyer is a person or company that purchases delinquent or charged-off debt from lenders at a fraction of the debt's face value, then attempts to collect. The debt buyer purchases from the creditor an electronic file, or “datastream,” of information about the portfolio of debts. Under the federal Fair Debt. Collection Practices Act, in general, a debt collector is a person or a company that regularly collects debts owed to others. Under the federal Fair Debt. Collection Practices Act, in general, a debt collector is a person or a company that regularly collects debts owed to others. Debt Buyer. Faced with debt? You may be able to avoid bankruptcy with the help of our New York debt relief lawyer. Request a free initial evaluation today. Under the federal Fair Debt Collection Practices Act, a debt collector generally is a person or a company that regularly collects debts owed to others, usually. Debt buyers usually only pay you pennies on the dollar for your unpaid invoices. The older the debt is, the less they'll pay for it. This is. Debt buyers often cast a wide net to find people who may owe money, resulting in the wrong people being targeted. If you are contacted by a debt buyer for money. IInformation to obtain a license from the Division of Financial Regulation if they engage in purchasing charged-off debt for the purpose of collecting it or. (6) "Debt collector" means a person who directly or indirectly engages in debt collection and includes a person who sells or offers to sell forms represented to. But the FDCPA usually doesn't apply to your original creditor. And if the party who's calling you to try to collect is a debt buyer, it might—or might not—have. Find out how debt buyers purchase charged off or overdue debts from a lender or creditor for a proportion of the debt. Is a debt collector calling? What can you do? What are your rights? The Fair Debt Collection Practices Act (FDCPA) makes it illegal for debt collectors to. 23 NYCRR 1, a regulation to reform debt collection practices by debt collectors, including third-party debt collectors and debt buyers. If you have received collection notices from a debt buyer, you may wonder, "What is a debt buyer and why are the debts purchased difficult to prove?" The short. Highlights: · Debt is money that you owe to an individual, a financial institution or a business. · Your creditors can transfer and sell your debt to a collection. Debt Collector Contacting Your Employer or Other People · To verify your employment; · To get your location information; · To garnish your wages (that is, taking. The debt buyer may attempt to collect the debt by dunning you (calling repeatedly) or the buyer may retain a lawyer and sue irk-pal.ru buying is a perfectly.

1 2 3 4